How does zero-fee Wootrade lead the liquidity revolution of cryptocurrency?

Popular automated market makers (AMM) such as Uniswap, Balancer, and Curve have recently brought the concept of “market makers” to the public eye. Market makers provide liquidity on exchanges and generally make profits through their own trading capabilities. Occasionally, market makers will charge the exchange separately when costs exceed profits. The exchange will then charge a fee to retail investors. Uniswap works similarly. The difference is that there is no centralized platform to charge a fee. Instead, Uniswap directly rewards the liquidity provider in the liquidity pool. Now imagine a scenario where even the liquidity provider does not charge any fees. Wootrade offers such a liquidity-providing platform.

Liquidity and zero fees

Taking BTC as an example, Wootrade can maintain a spread of 0.2% at a depth of 100 BTC. Moreover, it does not charge customers any handling fees or service fees. Wootrade was incubated by Kronos Research, a quantitative investment research institution. It is widely recognized that Kronos excels at a variety of trading strategies. Kronos has a daily trading volume of more than 1 billion U.S. dollars and can guarantee considerable returns in different market environments.

Although Wootrade implements zero-fee trading, it does not necessarily compete with retail-oriented exchanges. Wootrade users are mainly exchanges/DEXs, wallets, brokers, and trading institutions. More than 10 exchanges and institutional clients are currently connected to Wootrade. Furthermore, a total of more than 65,000 end users have used its trading depth through the exchanges that cooperate with Wootrade. After launching Wootrade 1.0, new exchanges were queuing up for access as market demand exceeded the team’s expectations.

Looking at the present liquidity solutions in the market, Wootrade’s advantages are:

- Compared to a single market-making team, Wootrade has no service fees, offers reduced market-making risks and a better depth;

- Compared with liquidity aggregation platforms, Wootrade with Kronos’ market-making support not only has better depth and faster transaction speed but also provides zero-fee transactions.

Comparison of BTC transaction spread between Wootrade and Coinbase

Wootrade’s basis for acquiring new customers is its unique zero-fee model and its superior depth vis-a-vis those of mainstream exchanges. After the exchange uses Wootrade, it not only solves the liquidity problem of mainstream currencies, the original hedging cost can also be used for other businesses (such as new purchases, trading activities, etcetera). This in turn will help the exchange gain new users and increase its trading volume. Clients using Wootrade saw their volume increased by a factor of 3.5. The retention rate of large traders also increased significantly.

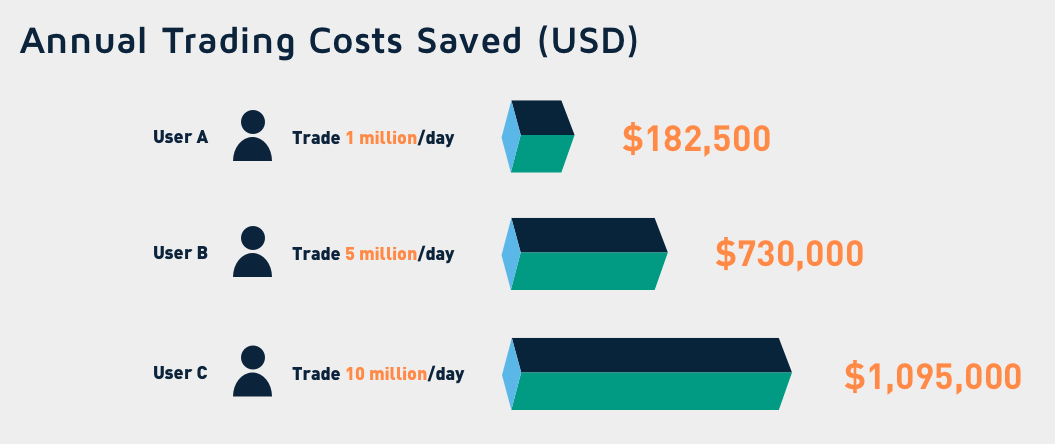

The annual handling fees that users with different trading volumes can save on Wootrade

Exchanges save costs, even when Wootrade earns revenue. Rather than a zero-sum game, exchanges and Wootrade have a mutually beneficial relationship. Wootrade helps the exchange improve its depth and save its costs of hedging → the exchange’s user base grows and sends more orders → the market-making strategy on Wootrade has the opportunity to obtain more benefits.

This “payment for order flow” already exists in traditional financial markets. Few can imitate this successfully because of the very high hurdles to trade with such capabilities. Robinhood, which is valued at 11.2 billion US dollars, is well known, but few people know that behind Robinhood’s success are the world’s top quantitative funds: Citadel, Two Sigma, Virtu, etcetera. Robinhood, as a US stockbroker, connects market makers such as Citadel to obtain liquidity and rebates. This not only guarantees zero commission fee for retail investors. It also provides retail investors with the retail price under NBBO (national best bid and offer). Market makers, such as Citadel, rebate these orders to Robinhood by their trading ability to obtain more profits.

It should be noted that Mark Pimentel, the co-founder of Wootrade, worked at Citadel and Knight Capital (acquired by Virtu in 2017) respectively. Mark first worked at Citadel’s high-frequency trading group, and then went to the electronic market-making group of Knight Capital. There he was responsible for operating at the largest dark pool in the United States at the time. Citadel and Virtu were also behind the success of the Robinhood. Mark identified a similar problem between quantitative funds and exchanges after entering the cryptocurrency industry, i.e. the market liquidity is fragmented. He hopes to apply his trading capabilities and dark pool experience to Wootrade. Adding the token economy to Wootrade will make this model more stable, fairer, and more efficient.

Tokenomics

Wootrade has its own native token which will serve as the carrier of value and rewards generated by the system. The exact functions of the token are as follows:

- Trading margin: tokens can be used as margin for trading accounts;

- Reward: provide quality orders and get token rewards as a Wootrade node;

- Staking: Stake tokens in a market-making fund or pledge to obtain governance voting points;

- Payment: Holding tokens to obtain investment shares in certain asset management products, and clients are able to get a discount when they pay the management fee using Wootrade tokens.

The team will use Wootrade’s revenue for secondary market repurchase, and will also reward nodes (exchanges, wallets, traders, etc.) that provide high-quality orders.

DeFi: AMMs and DEXs

Although automated market makers (AMMs) and decentralized exchanges (DEXs) both belong to the field of decentralized finance (DeFi), they are nonetheless very different from each other. AMM providers such as Uniswap do not have a limit order function, whereas the trading function of DEXs are more complete and more similar to that of a common crypto exchange. Still, AMMs are incredibly popular right now. They attract more users and have trading volumes exceeding those of DEXs.

Wootrade partners with DEXs. DEXs we have already partnered up with include MOV protocol of Bytom and Injective Protocol. DEXs using Wootrade solve their liquidity issues. Having more liquidity and offering more complete functions, exchanges will find it easier to attract many more users. Due to the popularity of the DeFi market, traditional exchanges have lower trading volumes in DeFi cryptocurrencies than Uniswap, and even lost users. Wootrade has already listed DeFi coins and will continuously list more, thereby supporting both centralized and decentralized exchanges to improve their competitiveness vis-a-vis AMMs.

Wootrade’s goal is to achieve 40% of the liquidity of the cryptocurrency market. This requires the onboarding of a large number of exchange clients and market makers. There is a huge opportunity of asset management business between investors from the exchanges and MMs on Wootrade. Because the trading team cannot be verified and trusted, investors often miss good opportunities. To solve this Wootrade will be equipped with an oracle machine. This enables market makers to send their NAVs and performance to the blockchain. Exchanges can then verify and select excellent products for its retail users.

Wootrade saw the possibilities of combining principles from traditional and decentralized finance. This new technology will quickly disrupt the crypto market. The traditional asset management business, also, will pay attention to the effective application of blockchain technology and token design.