Revamping WOO X business model to enable higher growth trajectory

Winning the market with competitive fees, sustainable incentives, and the introduction of a Zero Fee Zone

Tl;dr

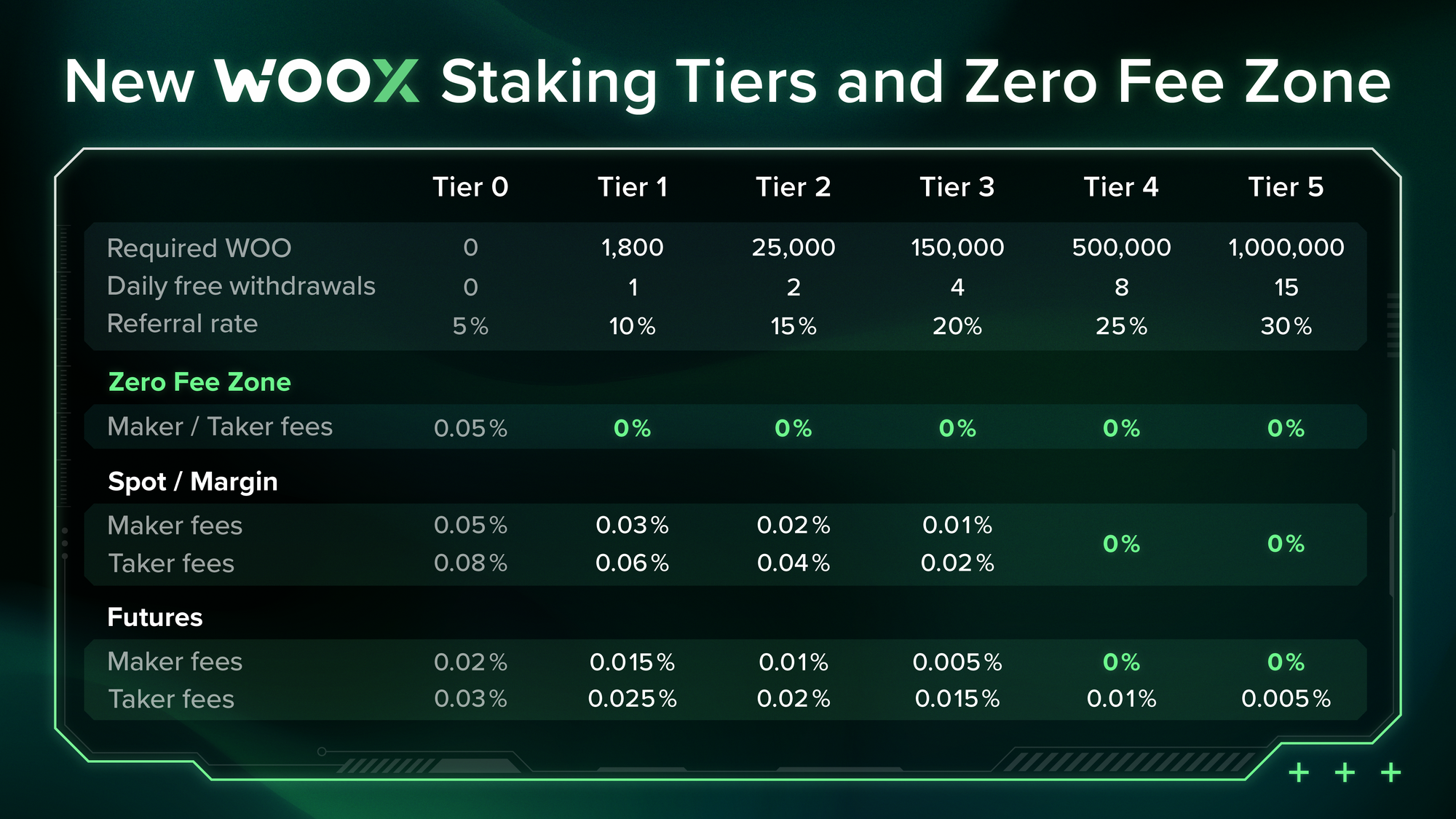

- The WOO X staking tiers have been streamlined, which includes increased base fees for Tier 0 traders and the introduction of taker fees for perp markets.

- Incentives will be further aligned across ecosystem participants to stimulate user growth and improve user experience. The primary objectives will be to reduce spreads, add new listings, improve liquidity depth, and fund rebates sustainably.

- Further improvements will be made to WOO tokenomics by removing rebate incentives funded in WOO tokens, strengthening connectivity between the staking program and new product launches, and most importantly, incentivizing users to stake at least 1,800 WOO or upgrade.

Reflecting on our growth journey and challenges along the way

In just a little over a year, we established WOO X as a respectable and innovative contender among the leading centralized trading platforms, launching a spot exchange, and adding perpetual swaps. WOOFi has evolved beyond its initial BNB Chain release to introduce new features like staking and Supercharger vaults, integration with LayerZero for cross-chain swaps, and deployment on new networks including Arbitrum, Optimism, and zkSync Era. It now sits as one of the most used decentralized applications, with over half a million monthly active users (MAU).

However, while WOO X has achieved a number of industry firsts, including zero-fee trading, a live transparency dashboard, and an execution analytics dashboard, there are a number of limitations that prevent it from reaching a higher growth trajectory. The main focus has been solving these challenges without sacrificing performance to users while delivering value to token holders.

Unsustainable rebates: With zero taker fees for spot and perp trading, WOO X cannot provide brokers, trading terminals, and affiliates with sustainable rebates. This led to WOO X offering rebates below market rates and funded in WOO tokens, which is not sustainable long-term.

Comparison to FTX/Alameda: Given the collapse of crypto asset exchange FTX and hedge fund Alameda Research, the market has grown increasingly distrusting of centralized operations. Despite WOO X being transparent and having significant controls and governance in place, the current model inhibits growth by inducing skepticism from new users.

Concentration of risk: WOO X’s existing single liquidity provider model, with the vast majority of all taker orders filled by Kronos Research, has a significant concentration risk. A number of institutional clients who expressed their interest in trading on WOO X have communicated their preference for diversifying liquidity providers on the platform.

Unclear user cost structure: The existing payment for order flow revenue model is inherently more opaque than earning revenue from trading commissions. Moreover, the cost borne by users has been typically uncertain via changing spreads, rather than a clear trading fee.

Unattractive custody ratio: WOO X provides Kronos Research with loaned capital to provide liquidity at the lowest possible cost, which is partially funded by deposits from clients. As reflected in our live dashboard, the custody ratio, which reports the share of clients’ deposits held in cold storage, typically hovers around 70-80%. By incentivizing more market makers to bring their own capital and provide liquidity, WOO X can improve the custody ratio and reduce the share of clients’ deposits outside cold storage.

Growth-hindering margins: WOO X has been undercutting too aggressively by offering significantly lower fees and staking requirements than other exchanges, even though overall execution quality is similar. WOO X, for instance, offered zero fees for spot and perp trading when users staked 1,800 WOO at Tier 1 on WOO X versus 3,000 BNB at VIP 7 on Binance or trading over $2 billion in monthly volume on OKX. We see an opportunity for adjusting our fee structure to facilitate several growth initiatives on WOO X while maintaining our commitment to provide users with the best execution quality.

The winning formula: New WOO X staking tiers plus Zero Fee Zone

As we charter into becoming the top global crypto exchange, we will invest more into upgrading our platform to accommodate more assets, improve trade execution, and enhance liquidity. In order to do this, changes will be made to the WOO staking tiers.

Staking tiers will be streamlined: The number of staking tiers will be reduced with the amounts between tiers becoming more prominent. This differentiation will help incentivize users to move up staking tiers.

Tier 0 will have higher fees: A Zero Fee Zone will be introduced on 60+ spot assets including BTC, ETH, AVAX, and other mainstream cryptocurrencies for users who stake at least 1,800 WOO. Remarkably, even with the new fee structure, WOO X fees are still competitive compared to other global CEXes.

Spot fees on less liquid pairs: For spot assets not included in the Zero Fee Zone, fees will be introduced with the aim of having consistent spreads and more flexible listing requirements.

Perp maker and taker fees will be introduced: The revenue from these fees will allow for sustainable rebates paid in USDT to brokers, trading terminals, and affiliates bringing new users, volume, and stakeholders to WOO X.

Through implementing these changes, several growth initiatives are emerging:

Streamlined process for new listings: Through diversifying liquidity providers and investing in listing infrastructure improvements, WOO X aims to compete with all global exchanges for listing new tokens immediately upon TGE or other liquidity events.

Rebate incentives will primarily be paid in USDT: The introduction of fees on perps means that brokers, trading terminals and affiliates can now earn competitive rebate incentives paid in USDT rather than previously earning lower rebates in WOO tokens. This change enables WOO X to rapidly scale its partnerships with many global platforms and ambassadors that can bring trading volume.

Designated market maker (DMM) program will diversify liquidity providers: Taker fees on perps will also enable WOO X to attract market makers to compete in providing liquidity on WOO X. This program provides eligible market makers rebates paid in USDT funded by taker fees. As a result, multiple liquidity providers will compete to quote tighter spreads and deeper liquidity across all perp markets. Importantly, the program will help diversify the liquidity providers and support significant growth in volume and open interest on WOO X.

An updated fee chart is shown below. Note: New fees and changes to staking tiers will take effect on Jul 3, 2023. For any questions, please contact support.woo.org

On becoming a top global crypto-asset exchange

All in all, these improvements are aimed at building on the innovations WOO X has brought to the market, alongside our core values, reputation for transparency, and trader-focused features. We expect a net positive outcome for our ever-growing ecosystem - our users, partners, and investors - as a result of our business model revamp.

As these changes are implemented, WOO X aims to better align the incentives of all ecosystem participants by funding growth initiatives with improved rebates for affiliates and brokers & trading terminals, investing in new products and feature requests for the platform, enhancing our listing infrastructure, and forming impactful partnerships with leading ecosystems and applications.

Through introducing perp taker fees and launching the designated market maker (DMM) program, WOO X is working towards onboarding more market makers and diversifying the liquidity providers on the platform. These changes should help the custody ratio should gradually increase towards 100% where users' assets are secured in cold storage and unencumbered from any loans or obligations. Additionally, multiple market makers help to reduce operational risk and improve the platform’s robustness.

At the center of all these developments is the increasing utility of the WOO Token. Users will be incentivized to stake larger amounts and move up tiers in order to unlock the largest fee discounts, premium benefits and access to new products. The fee changes will support funding referrals and broker incentives in USDT rather than WOO, which helps reduce WOO token inflation.

—

The content above is neither a recommendation for investment and trading strategies nor does it constitute an offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.