A Comparison Between the Collateralized Crypto Lending and the Repo Market (p4)

Past price drop events were largely due to a single event that caused a subsequent mass sell-off. What is different now is that the new crypto financial ecosystem brings the possibility of a systemic risk due to the interconnected nature of the different products and services. A price drop that was caused by a single event could become exponentially worse because it triggers a larger scale sell off throughout different channels.

On March 12th, as Michael Moro of Genesis Capital claimed, was the biggest deleveraging event that the space has seen. While many point to the sudden selloff due initiated by the drop in the traditional financial markets, the severity of the drop was largely attributed to the derivatives trading platforms that forced a mass flood of liquidations. The liquidations in the derivatives platforms/price drop then led to even more liquidations in lending as the price of the collateral collapsed.

Private lenders appeared to have had relatively limited damage and with some reporting that they received most margin calls with few liquidations. The private lending volumes have remained small after the crash with some, like industry leader Genesis Capital, suspending lending activity all together for a few weeks.

The after effect for DeFi was much more pronounced, reaffirming the belief that decentralized lending is not ready to become mainstream. MakerDAO is a prime example of how a breakdown in one area can quickly cascade into an event that could potentially cause a catastrophic collapse in the underlying assets price. The sequence of events as explained by Kyle Samani are summarized below.

•A software glitch led to miners not including the liquidation transactions that were occurring due to the price collapse. In one extreme case, the software glitch is what led to one person walking away with $8 million in ETH for free.

•The price oracles were not configured to operate in this high transaction volume environment, so they eventually stopped reporting prices. But this arguably prevented further collapse as the system failed to report from the time ETH reached $100 and stopped more liquidations from taking place.

•Had the liquidations continued it could have potentially led to the insolvency of DAI because the backstops that were supposed to contribute back to the collateral pool had failed.

•A MakerDAO insolvency event could have spread to the rest of the DeFi platforms and further compounded the ETH selloff.

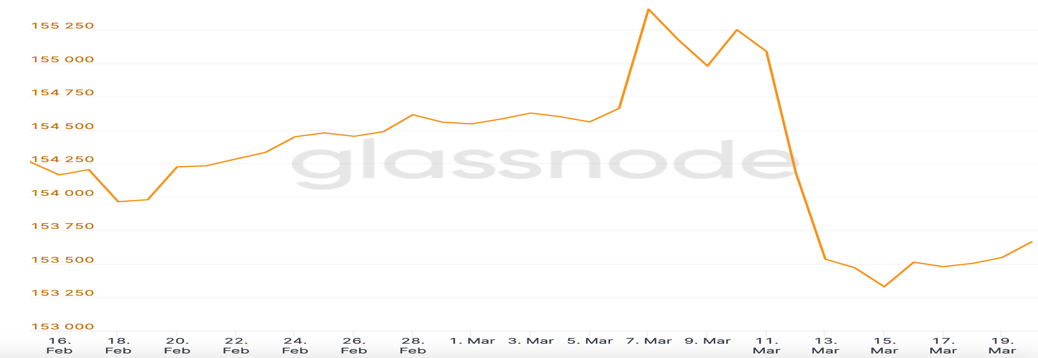

Due to the crash, the Ethereum blockchain witnessed the biggest daily drop in the number of ETH addresses with more than 10 ETH (shown below)

SOURCE

23.DiCamillo, Nathan (2020 March 13) $100M+ in Margin Calls: Crypto Lenders Demand Collateral as Market Buckles. https://www.coindesk.com/100m-in-margin-calls-crypto-lenders-demand-collateral-as-market-buckles

24.Cheng, Yiuln (April 8 2020) Genesis Global Trading Suspends Credit Extension https://www.theblockcrypto.com/post/61305/genesis-crypto-credit-suspends-extension-market

25.Samani, Kyle (2020 March 17) March 12 The Day the Crypto Market Structure Broke https://multicoin.capital/2020/03/17/march-12-the-day-crypto-market-structure-broke/

26.Defirate (2020 April) https://defirate.com/lend/?exchange_table_type=borrow