Exploring the world of cross-chain swaps

Reflections on the current state of cross-chain swap user experience by WOO Network’s Head of DeFi - Kevin Feng

First and foremost, wtf are cross-chain swaps?

Cross-chain swaps are simply the conversion of one asset from chain A to another asset of different value on chain B. Their distinct advantage lies in their ability to do that which bridges cannot - swap two assets that have different values (i.e. ETH on Mainnet for BNB on BNB Chain).

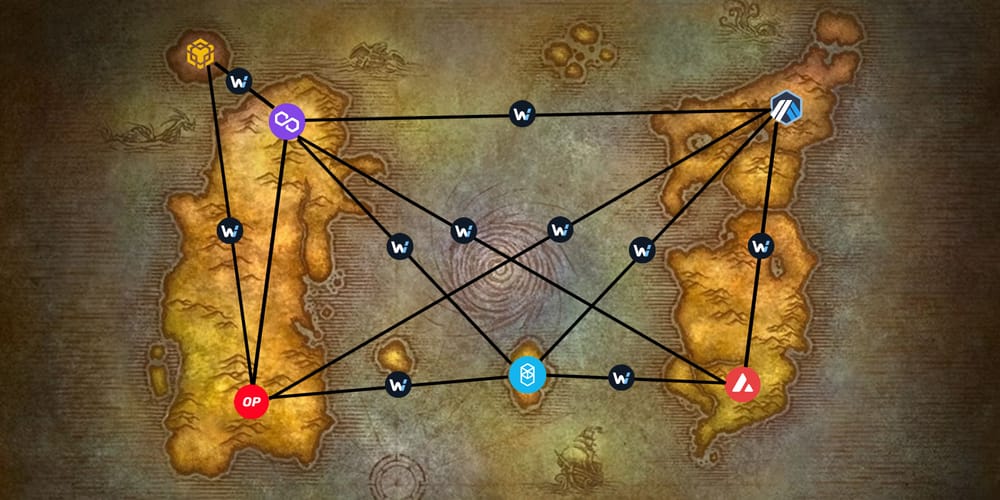

The multichain narrative emerged last cycle, and since then blockchains have become comparable to countries with borders and sometimes different ‘currencies’. Many dApps such as Curve Finance, AAVE, Uniswap, and WOOFi have deployed across multiple blockchains so as to tap into the market in those ecosystems. As cross-chain interoperability improves, I expect cross-chain swaps to become the default feature in most multichain dApps - but we are not there yet.

Cross-chain swaps sound great, so why aren’t people using them?

Most users are very comfortable with the Uniswap-like swapping experience, and the UX of domestic swaps (i.e. swapping assets on the same blockchain) has been pretty standardized. When you are crossing the ‘border’ of a blockchain, the process is asynchronous and the UX isn’t good enough. Although the concept of a cross-chain swap doesn’t feel strange anymore, most people are just experimenting with it in NFT quests or product testing. Generally, people are still not comfortable with using cross-chain swaps as part of their routine operations.

The most common concerns I’ve heard about cross-chain swaps are:

- Assuming they would get more assets at the end if they manually swap and bridge the assets through various dApps

- Feeling uncertain about the process and not knowing when they’ll receive their assets or where they can check to see if their assets actually arrived

What does a good cross-chain swap experience look like?

Take international flights as an analogy - they have more complex procedures than domestic flights but ultimately the experiences are largely consistent. To provide users with a good cross-chain swap experience, DEXes need to ensure consistency in both execution quality and user experience.

- Execution quality

The output that a user receives on the destination chain should always be equal to what they would have received had they manually bridged (dex->bridge->dex). It’s hard for one solution to always offer the best results in all situations, but as long as they are close the delta can be offset by the convenience of cross-chain compared to the cumbersome manual process. To execute it manually each step takes time and gas fees, and oftentimes you need to approve to spend tokens on multiple smart contracts which pose additional risk.

Some multichain AMMs are offering cross-chain swaps and they support a wide range of assets, however, due to the disparity in TVL between various assets across different chains users sometimes get execution far worse than the market rate. That’s why we are seeing some cross-chain swap dApps aggregate multiple DEXes and bridges to ensure optimized execution.

WOOFi’s sPMM bridges CeFi liquidity into every single integrated chain. This puts WOOFi in a unique position to ensure there is no disparity in execution quality regardless of which source or destination chain is selected. Anyone cross-chain swapping with WOOFi can rest assured that they won’t suffer from worse execution because they choose a chain that may have less liquidity on certain assets.

2. User experience

The domestic swap experience is pretty binary. After you execute the transaction you either get the number of assets quoted or the transaction is reverted if the slippage exceeds the setting. I think cross-chain swaps should provide a one-click user experience, dApps should handle everything behind the scenes after users indicate the assets and destination chains and initiate the transaction. The process also shouldn’t be vulnerable to interruption from human errors like the user not realizing whether and when they need to sign another transaction or failing to switch chains or closing the window by accident.

The speed of the cross-chain swaps is another area for improvement - it currently takes anywhere between 30 seconds and 20 minutes depending on the status of the source and destination chains. I’m not too worried about this because we have so many amazing builders in the space to make the tech better, just don’t rush to integrate new chains and bridges usually that come with higher uncertainty and security risk.

Some cross-chain swap dApps are providing aggregation services which is a great improvement to ensure users always get the optimized execution quality, but some are at the cost of user experience consistency. Users are sometimes required to sign multiple transactions on different chains during the process, which in my opinion is not a good trade-off.

WOOFi chose to build on top of Stargate and LayerZero because we wanted to provide users with a consistent one-click experience similar to domestic swaps. And we stick to this product choice to keep the user experience simple until the technology of bridges and cross-chain messaging is more standardized to enable a more frictionless experience.

WOOFi is on the way to building a well-balanced cross-chain swap user experience

WOOFi is a pioneer in cross-chain swaps and was one of the earliest protocols to deploy on Stargate back in June 2022. Almost 50,000 cross-chain swaps have been processed since then, and we have continually listened closely to user feedback to direct us on how to further improve the feature.

Recently a proposal was passed in Stargate’s governance forum to add WOO pools on Stargate across 7 different chains so that WOOFi users can natively bridge WOO or cross-chain swap with other assets on the WOOFi UI at an even lower cost. This is one of many steps that will make WOOFi the omni-liquidity layer that provides users with a seamless cross-chain swap experience.

There are many exciting developments in the space to improve the multichain dApp experience. The recent bridge war for Uniswap BNB Chain deployment has demonstrated the importance of cross-chain messaging infra, and projects like LayerZero, Celer, Wormhole as well as Circle’s CCTP will gradually help eliminate the fragmentation of cross-chain liquidity and make cross-chain swaps more efficient and affordable. And that can be leveraged by the dApp builders. At the application level, we have many strong builders such as Li.Fi, OpenOcean, Thorswap, and Unizen (just to name a few) who are striving to provide the best user experience for cross-chain swaps.

I’m very optimistic about the future of multichain dApps with a unified user experience that aggregate liquidity and yields across different blockchains. They will become household brand names to help onboard the next millions if not billions of users to DeFi.

The content above is neither a recommendation for investment and trading strategies nor does it constitute an offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.