WOO X lists Tether Gold — but what is XAUt all about?

Now you can be a gold bug, without leaving your favorite trading platform

WOO X lists Tether Gold

$XAUT is now listed on WOO X! This means you, our lovely #Woorior can be a gold bug yourself, while still remaining on your favorite trading platform. Just in case you need some (tokenized) gold to weather the bear!

Bitcoin + Gold Correlation

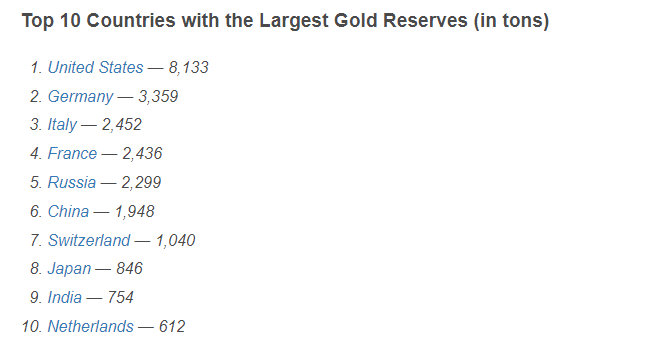

Since the origins of Bitcoin, there have been comparisons to gold. Bitcoin has taken on many forms over its lifetime, however, it is repeatedly referred to as “digital gold” because of the sound money principles it adheres to. For a brief history lesson on this subject matter, gold has commonly been known as “hard money”. The distinction between “hard” metal coins and “soft” paper (or fiat) money was because they were solid, metallic, physical tokens with intrinsic economic value independent of their monetary status. Fiat money was at one point backed by, or could be exchanged for gold. However, in 1971 Richard Nixon undertook a series of economic measures called the Nixon shock, which took the US Dollar off the gold standard. Even today gold is held by central banks to support the value of their respective currencies.

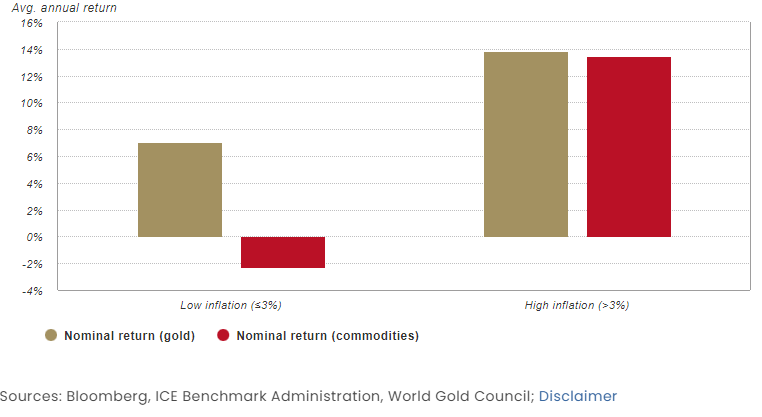

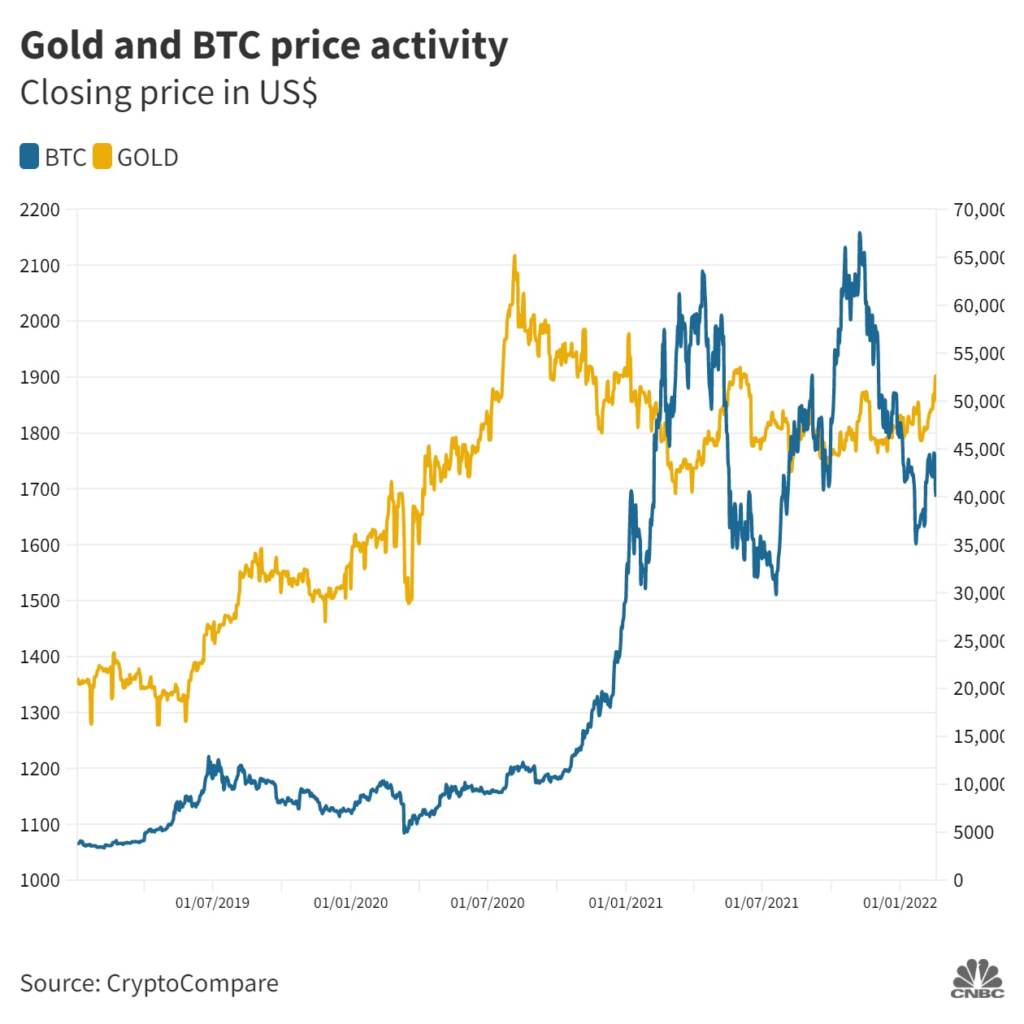

One narrative sold for BTC over the last few years was that it could be used as an “inflation hedge” similar to its physical counterpart. Some would also call this sort of thing a “safe haven asset”. That has certainly not proven to be the case in 2022, in a year with inflation at historical highs. Unfortunately, in the eyes of Wall Street, Bitcoin and other crypto-based investments have mostly been seen as similar to high beta tech stocks as opposed to an inflation hedge. However, gold on the other hand has a proven historical track record of performing against inflation.

You can see here that at the beginning of the 2020 bull market, the Bitcoin vs Gold price had a sharp incline. However in the recent 6–8 months since the end of 2021, the price has declined as a result of the recent bear market.

To add to this point, at the Sohn 2022 conference, Stanley Druckenmiller, one of the most famous hedge fund managers of all time said the following two statements:

“If it’s in a bull phase, you want to own Bitcoin. If it’s in a bear phase for other assets, you want to own gold”

“There certainly seems to be a strong correlation between crypto and the Nasdaq”

It is no secret that crypto and the S&P have been tightly bound to one another for quite some time. However, it’s important to note that in the context of that statement, while still obviously comparing the two assets, Bitcoin is viewed as more “risk-on” whereas gold is viewed as more “risk-off”.

What is Tether Gold?

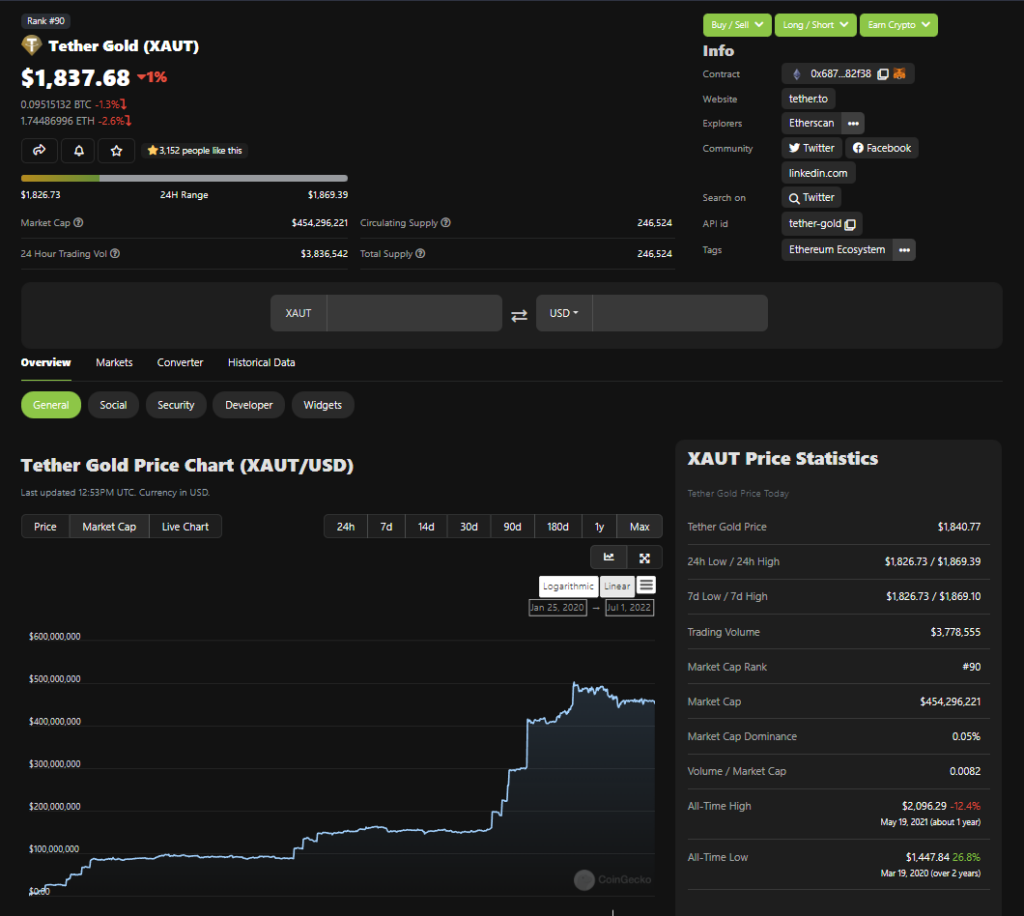

Tether Gold (XAUt) is a digital asset offered by TG Commodities Limited. One XAUt token represents one fine troy ounce of gold on a London Good Delivery (LBMA) gold bar. The fractionalization of XAUt tokens is possible up to six decimal places (i.e. in increments as small as 0.000001 fine troy ounce). In simple terms, Tether Gold is a digital, tokenized representation of one ounce of gold.

You might not realize it, but Tether Gold is ranked #93 on CoinGecko. At the time of this writing, it has a market cap of 459 million.

How is the gold stored?

According to Tether’s website, Tether Gold will purchase or arrange for the purchase of London Good Delivery gold from a gold dealer in Switzerland, which will then be securely stored by a custodian in a vault in Switzerland. The gold will be held for the benefit of XAUt token holders, not for Tether Gold. The custodian maintains insurance with regard to its business in such amount and on such terms and conditions as it considers appropriate.

Stay tuned for all WOO Network’s exciting developments!

- Socials: https://linktr.ee/WOOnetwork

- Website: https://woo.org

- Telegram Announcements: https://t.me/woonetworkann

- Medium: https://medium.com/woonetwork

The content above is neither a recommendation for investment and trading strategies nor does it constitute an offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.