Introducing Isolated Margin on WOO X

Wish you had finer control over your leveraged perpetual futures positions?

Now is the time to ditch your endless lists of subaccounts with the introduction of the Isolated Margin feature on WOO X. We’ve heard all your requests, and we're excited to now bring you a solution that further enhances your trading experience.

Let’s learn a little more about what Isolated Margin is, why traders should use it, and how you can get started.

What is Margin?

To understand the need for isolated margin, it's essential to first grasp the concept of margin itself.

When traders trade in perpetual futures markets with leverage, they borrow funds from the exchange to take on a larger position than they could afford with their own capital. To do so, they would need to use existing assets in their account as collateral to secure the ‘debt’.

This collateral is referred to as 'margin,' and there are two primary modes for managing it: Cross Margin and Isolated Margin.

By default, the margin mode used on WOO X is Cross Margin.

Cross Margin v.s Isolated Margin

So what exactly differentiates the two?

In cross margin mode, all available funds in your account are being used as collateral for all your perpetual futures positions. If one position moves against you but another position is in profit, that profit is used to cover the loss, allowing you to keep your position open longer.

In isolated margin mode, you can control how much funds to allocate as collateral for a single position, without affecting the rest of your account balances.

While this might sound straightforward, choosing the right mode really depends on your individual needs. Here's a summary of the pros and cons for each mode:

Isolated Margin

Cross Margin

Generally, for traders who wish to control the maximum losses for a particular position, isolated margin mode is a great way to help achieve this. To summarize, isolated margin can help separate risky positions from your other core positions.

Enabling Isolated Margin on WOO X

Ready to make the switch?

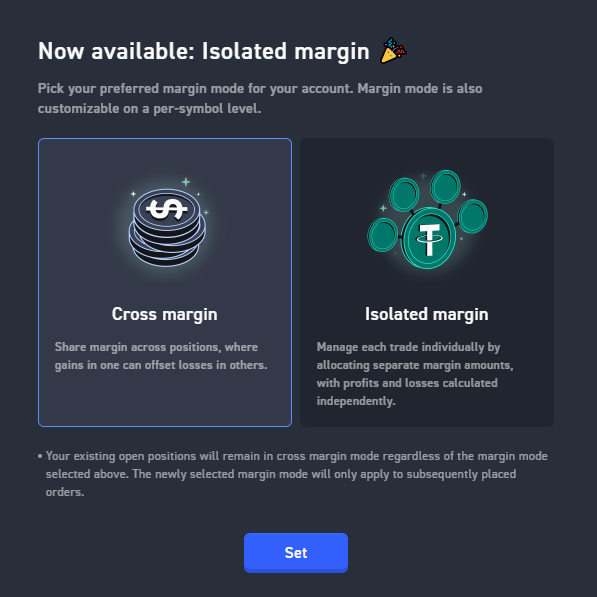

Upon logging in to WOO X, you will receive a dialogue box where you can choose between Cross Margin mode or Isolated Margin mode. This setting will apply to your whole account, and any subsequent positions that you open.

If you have any existing open positions already in cross margin mode, they will remain unchanged. Your new settings will only apply to subsequent new orders.

Accidentally chose the wrong setting? You can always come back to these settings later by heading over to your account settings page and selecting the ‘Margin & Futures’ tab.

Setting Margin Mode for individual symbol

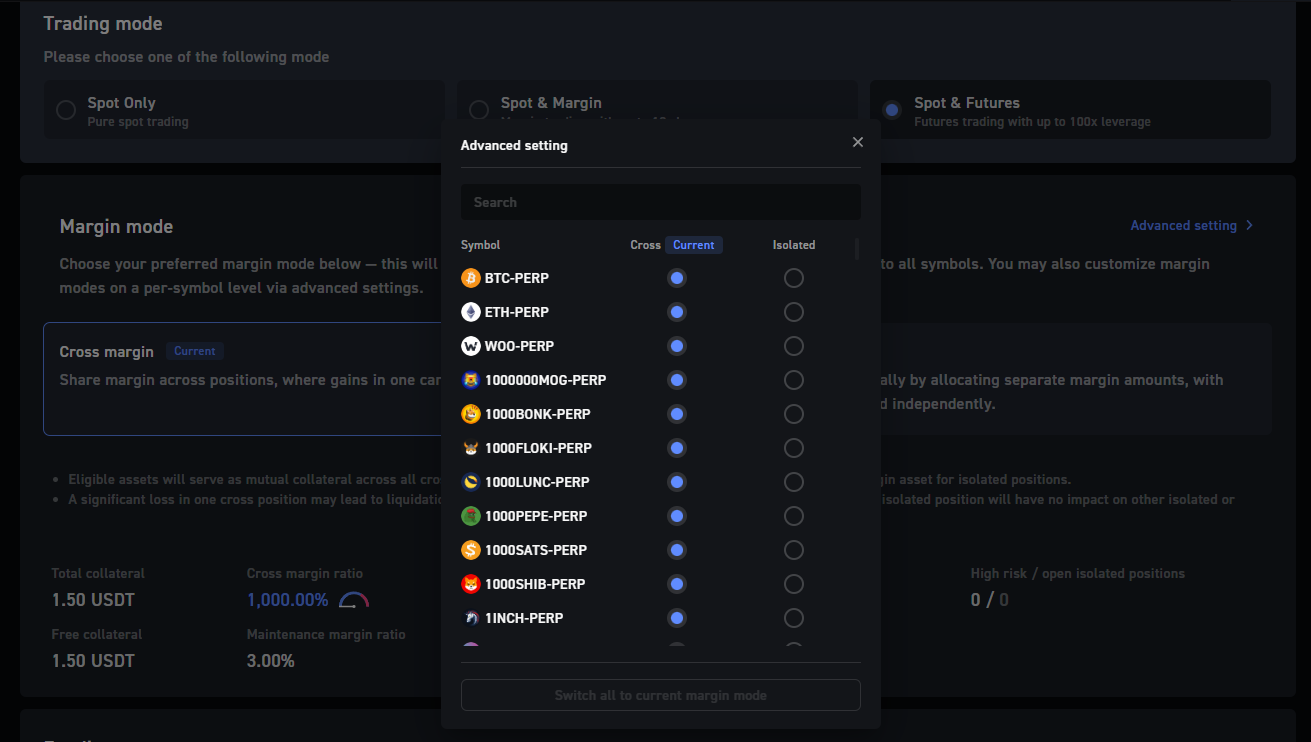

In addition to this, you can also select your desired margin mode on a ‘per symbol’ level. To do so, simply look for the margin mode option on your order entry tool when making an order, right next to the leverage setting.

Alternatively, you may set the margin mode on a ‘per symbol’ level by heading to the account settings page, click on ‘Margin & Futures’ tab, and select advanced settings under ‘Margin Mode’.

Adjusting Margin

It is important to always manage your margin amounts judiciously for all your isolated margin positions. Proper margin management helps ensure that you maintain control over your trades and avoid potential liquidation.

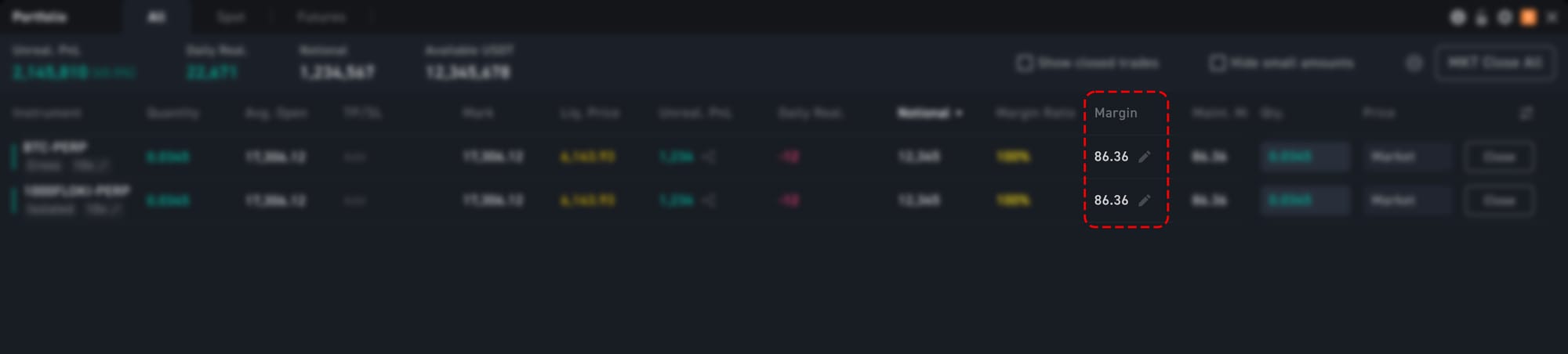

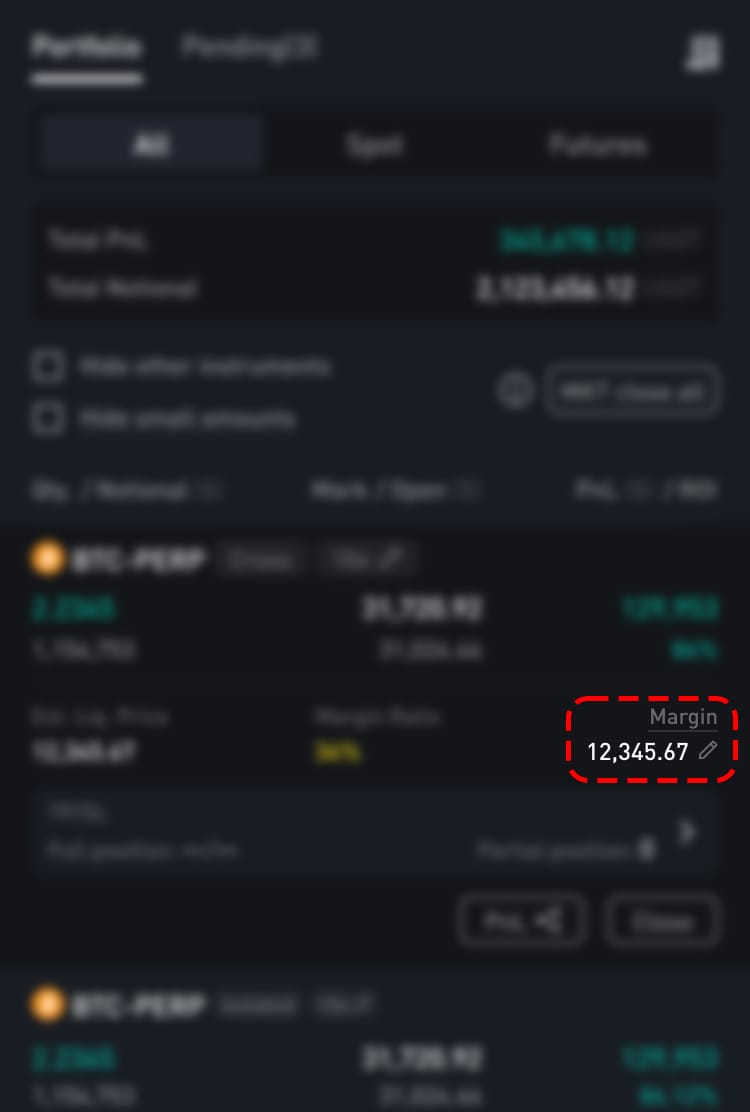

To adjust your margin, check the ‘Portfolio’ widget on desktop, or the ‘Portfolio’ tab on mobile. Look for the margin amount for your position, and click on the pencil icon to adjust the margin.

You will be able to adjust the margin amount by either adding or reducing the amount.

Upon input of your desired amount, you will see an updated ‘position margin’ amount, as well as an updated estimated liquidation price.

Adjusting Leverage

It is also possible to adjust the leverage amount of your isolated margin positions. To do so, simply look for your existing open position and click on the leverage amount.

Please note that as you reduce your leverage, more margin is needed to maintain your position. More margin may be automatically added to your isolated margin position if the margin is insufficient upon reducing the leverage. This information will be noted in yellow in the confirmation dialogue box.

Next, click on ‘Confirm’ and ‘Add’ to add the additional margin amount.

Do note that when increasing the leverage, any surplus margin will still remain in the isolated margin position, but is available for withdrawal if desired.

Conclusion

And that’s it!

We’re excited for traders to start trying out the Isolated Margin mode on WOO X, and we believe it will significantly enhance your trading experience.

If you have any specific feedback regarding the feature, please let us know via the Support Center.

Happy trading!

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial, investment, legal, or professional advice of any kind. While we have made every effort to ensure that the information contained herein is accurate and up-to-date, we make no guarantees as to its completeness or accuracy. The content is based on information available at the time of writing and may be subject to change.

Please note that this article includes references to third-party websites and data, which are provided solely for convenience and informational purposes. We do not endorse or assume any responsibility for the content, accuracy, or reliability of any information, products, or services offered by third parties.

Cryptocurrencies, staking, and restaking involve significant risk and may not be suitable for all investors. The value of digital currencies can be extremely volatile, and you should carefully consider your investment objectives, level of experience, and risk appetite before participating in any staking or investment activities.

We strongly recommend that you seek independent advice from a qualified professional before making any investment or financial decisions related to cryptocurrencies or staking. We shall in NO case be liable for any loss or damage arising directly or indirectly from the use of or reliance on the information contained in this article.