WOO X further enhances platform liquidity by expanding the designated market maker program to spot markets

The success of the business model revamps and recent milestones put the goal of achieving a 100% custody ratio on track

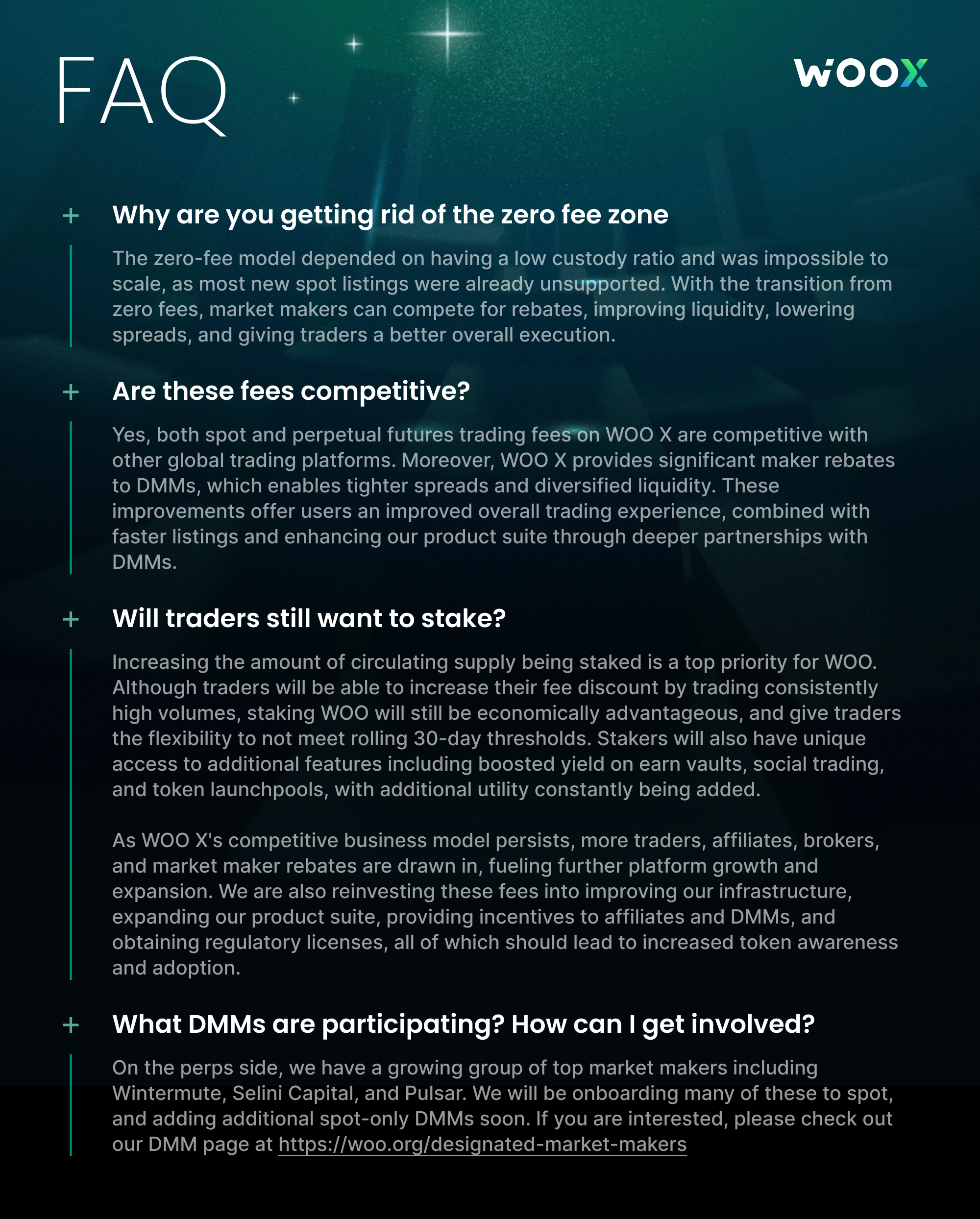

TLDR:

- WOO X has expanded its designated market maker (DMM) program to spot assets, in efforts to completely move away from reliance on a single market maker model

- Perp maker volumes are now 80-90% DMMs, led by Wintermute, Selini, and Presto

- Zero fee zone to be removed as platform liquidity and 100% custody ratio take priority

In less than nine months, following the initial revamp of our business model, we've achieved a succession of remarkable milestones, driven by our goal to provide our traders with tighter spreads, reduced trading costs, and more diverse liquidity sources. We are near our goal of achieving a consistent 100% custody ratio by the end of Q2 2024, propelled by the success of our liquidity model changes.

Reviewing our transformation

The WOO ecosystem started in 2019 as an institutional liquidity network, supported by a single market maker model that aggregated liquidity from across all mainstream centralized exchanges. This innovation was successful in providing access to the lowest fee tiers in all of crypto, with a full zero-fee model for both spot and later perps. However, this model later proved to be limited when the amount of high-volume, long-tail assets skyrocketed, making it difficult for any single MM team to manage, and later after public perception towards single market maker models soured in the wake of FTX collapsing.In mid-2023, WOO X took the first step by diversifying liquidity on perpetual futures markets. A lot of backend optimizations were built to support the performance requirements of the trading system, but WOO X turned heads by forging relations with strong partners like Wintermute and Selini, who were instrumental in the transition. Currently, DMMs are averaging 80-90% of all perp market share after starting around 5% in August 2023. The transition seems to be having the right effect as WOO X’s volumes, market share, and open interest have all increased, indicating heightened trust and preference by traders. The increased fee revenue has improved the financial sustainability of the platform, enabling WOO X to align fee rebates with DMMs, brokers, and affiliates.

Changes to spot fees

In line with our ongoing efforts to make WOO X the most robust and liquid centralized exchange, we're streamlining our fee structure anew for a stronger net positive effect for all our users. The new fee rates will take effect on March 5, 2024.

Dual-tier model: The new structure allows traders to enjoy the benefits of lower fees on WOO X by either staking or increasing trading volumes. These volume tiers are based on the current trader demographics on WOO X but may be subject to change as the platform scales. These VIP tiers will go live near the end of March or early April.

Fee discounts by volume

The legacy staking design caused many traders to miss out on experiencing WOO X's competitive cost structure, as they were discouraged by the large upfront cost of staking WOO. We are addressing this issue by introducing a conventional system that simplifies trader onboarding by reducing fees as trading volume increases. As their confidence in the platform grows, they can experience even more discounts, flexibility, and features by staking WOO.

Despite introducing this dual system, staking WOO on WOO X still provides users with a more economical alternative. For example, a user trading $100K in average daily volume would pay approximately $3,000 monthly as a VIP 0 user. By staking 1,800 WOO to VIP 1, the user would save around $600 in trading fees monthly, in addition to earning yield and increasing access to other innovative products like earn vaults and launchpools planned to be launched throughout 2024. With the new changes, onboarding users will be faster than ever, allowing more people to enjoy the benefits of staking WOO on WOO X.

Note: For VIP traders on other exchanges, feel free to reach out about our VIP Matching program, as you may be eligible for enhanced fee discounts and other benefits.

Better liquidity and even less counterparty risk

Another change is the removal of the Zero Fee Zone, which allowed users to trade select major spot markets without fees, once staked to Tier 3. The downside to this model was the continued reliance on a single market maker model, which many users and institutions were uncomfortable with. The introduction of fees and DMMs translates into improved liquidity while allowing WOO X to move towards a 100% custody ratio. After years of facing questions around its business model, WOO X’s market-leading transparency with live proof of reserves and liabilities will stand out among the other centralized platforms.

Check out our DMM page at https://woo.org/designated-market-makers

—

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.