Re-evaluate your biases #TradingOutlook - Powered by KTG

An increased volatility, combined with low liquidity requires constant re-evaluation of biases.

BTC started last week trading in the range established in the previous weekend after an earlier sell-off.

It registered a false-breakout first to the upside on Monday and then to the downside later, sweeping out liquidity on both sides of the range.

It looked like sellers who were pressing the market down in the previous week lost steam and couldn’t send the market lower.

Buyers gained the upper hand on Tuesday - helped by banking sector worries growing after First Republic Bank reported exit of half of depositor’s money.

That led to a BTC safe-haven buying with bank shares (led by FRC) sliding. Eventually BTC managed to break out of the range and finished strong on Tuesday.

It was followed by an acceleration of the move to the upside on Wednesday with shorts that were opened on the down-move in the previous week being squeezed.

The market found resistance at $30,050 - almost exactly at the level where huge market orders started to be sent to the market a week earlier.

However, Arkham’s alert on Mt Gox and US Govt transactions hit the wires hours later.

Market makers pulled liquidity and saw a quick dump to the $27,000 area, which worked as a support previously.

This coincided with the alert being called off as erroneously sent. BTC bounced and made its march up on Thursday.

Since then, it had been trading in the $28,900 - $30,050 range with failed attempts to push above on Sunday. Eventually on Monday, BTC started rotating down.

We see increased volatility on the market combined with low liquidity, which leads to abrupt market moves both to the upside and downside.

Some traders may elect to trade from level to level, looking at how the price reacts at and around prices where it did before.

The market is interesting and gives many opportunities, but it’s important not to be too biased or greedy as it’s easy to be chopped out.

It may be worth paying yourself by taking some partial profits when the market is cooperating and gives extended moves.

For some, buying close to important resistance, or selling close to important support could be very risky unless for quick scalps or to take advantage of a pattern you know and see with a clear action plan.

What’s worrying for bulls now is that last week, BTC didn’t manage to close not only above 2023’s high of $31,070, but also previous week’s high of $30,480.

On the other hand, we have challenges from the downside. All in all, BTC stays in the $26,500 - $31,070 range.

Important levels/areas to watch from the downside are now $27,900, $27,000, $26,500, $25,300 - $25,000 (with the last 2 being key from a longer term perspective).

From the upside, we have $30,050, $30,500, $31,070, $32,400, $40,000 with some smaller levels in between.

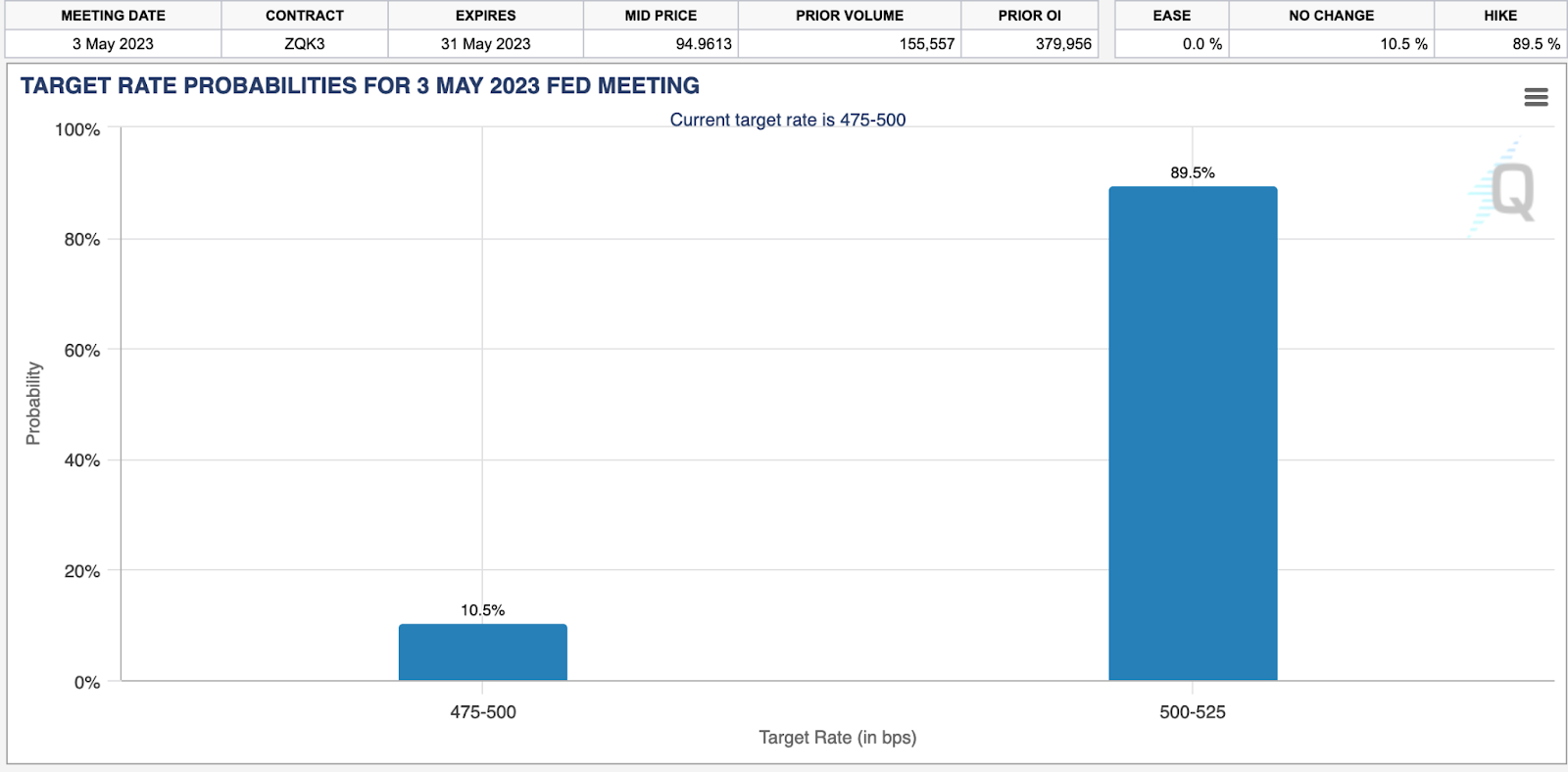

Another busy week for macro. Key event being Fed rate decision and presser on Wednesday. Expectations for 25bps hike are at 90% probability as of now.

We also have ECB on Thursday and US job data through the week with the most important one – NFP on Friday.

In summary, look out for these events this week:

Mon : Manufacturing PMI, ISM Manufacturing

Tue : Eur CPI, Factory Orders, JOLTs

Wed : ADP, Services PMI, ISM Non-Manufacturing, FOMC Rate Decision and Presser

Thu : ECB Rate Decision and Presser, Jobless Claims

Fri : NFP

After a return of fear in the banking system last week, it’s worth keeping an eye on further developments this week.

Buckle up, get ready for increased volatility and good luck with your trading this week.

Trade now on https://x.woo.org/ and follow @KTGglobal for more trading insights.

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes to their investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.