Bitcoin: What's going on with ordinals?

Ah Bitcoin. Our first love.

We know it’s been a tough few years, but with you being approved for spot ETF trading, things are looking up. We also see you’ve been working on yourself and, needless to say, we like what we see.

Jokes aside, 2023 has been interesting for the world's oldest cryptocurrency. We started still feeling the aftershocks of the FTX collapse and we finished with a US spot ETF approval. Now, as gaining exposure to Bitcoin becomes easier via some of the largest institutions in the world, it’s easy to forget that January brought something that few of us expected: NFTs on the Bitcoin network.

These NFT-like assets, ordinals, have re-energized and divided the Bitcoin community in a way not seen since Taproot and Segwit. What started as an experiment in extra functionality and fungibility has grown into a fully-fledged ecosystem.

This means it’s time to strap in as we take a trip through ordinals, into BRC-20, and beyond, unpacking exactly what’s going on and considering what this might mean for the orange coin.

What are ordinals?

It all started when Casey Rodarmor and his experiment, ordinals, brought NFT-like functionality to the Bitcoin network by allowing the inscription of individual Satoshis.

From Casey's blog post, inscriptions are digital artifacts native to the Bitcoin blockchain. He also states that while digital artifacts are NFTs, not all NFTs are digital artifacts.

This is because most NFT content is stored off-chain, exists on centralized chains, have back-door admin keys and is smart contract-driven, and for an NFT to be considered as a digital artifact, it must be decentralized, immutable, on-chain, and unrestricted.

Inscriptions are true digital artifacts as they tick all of Casey’s boxes.

BRC-20: A token standard, but not as you know it

This brings us to BRC-20 tokens.

Initially launched by anonymous developer domo on March 9, 2023, BRC-20 tokens build on ordinals using an experimental standard to create Bitcoin-native fungible tokens.

The key difference here with ERC-20 tokens is that BRC-20 tokens do not use smart contracts.

Instead, they attach a script file to an ordinal inscription, allowing users to deploy, mint, and transfer tokens.

This has set the Bitcoin community ablaze, with early adopters and experimenters racing to create their own BRC-20 tokens.

New and existing infrastructure providers have also jumped on the trend, with wallet providers, aggregators, marketplaces and more integrating or building on the BRC-20 standard.

Diving deep into BRC-20

What started as an experiment has led to an explosion of innovation on the Bitcoin network, and here are some first-movers we’re keeping an eye on.

Wallets

Wallets are the gateway to all things Ordinal, and while BRC-20 and ERC-20 sound similar, they’re fundamentally different token standards. This means you need a compatible wallet, and there are already plenty of options. Unisat, Ordinal Safe, Ordinals Wallet, and Xverse all support ordinals and BRC20, with Unisat coming out on top as the first Ordinals compatible wallet. Hiro from Stacks also adds Bitcoin L2 support and, more recently, Phantom, the leading Solana wallet, has also announced Bitcoin and Ordinals support. Given Phantom’s massive user base, this is a huge vote of confidence for the fledging ecosystem.

Inscription services

Inscribing individual Satoshis is almost rocket science to the uninitiated, requiring one to download Bitcoin Core, install Ord, run a full Bitcoin node, create an Ordinals wallet, and send some satoshis to its address. Thankfully, inscription services have popped up to smooth out an otherwise bumpy UX road.

Gamma, for example, provides a no-code Ordinals launchpad that allows users to inscribe their Ordinal NFTs without the technical hurdles. Ordkit offers a similar service, allowing users to bundle transactions for a flat fee regardless of the number of transactions they want to process.

Marketplaces

Once you’ve got your Ordinals minted and your inscriptions inscribed, you’ll need somewhere to sell your wares: a marketplace.

Established platforms like MagicEden have entered the Ordinals race, recently launching support for this burgeoning ecosystem.

Where NFT marketplaces emphasize the ownership, transferability, and value of one-of-a-kind digital content, ordinal marketplaces enable the trading of ordinal numbers, with value derived from each inscribed satoshi's relative position in a given block.

The great BRC-20 divide, or, wizards vs. cat-eaters

While Ordinals have brought fresh attention to the Bitcoin network, to say the community is divided would be an understatement.

Some view Ordinals as an exciting new development that brings fresh use cases to the Bitcoin network, expanding beyond just financial transactions and into ‘culture’.

At the forefront of this charge into the unknown is Udi Wertheimer, and with his fellow Taproot Wizards, he’s on a mission to “make Bitcoin magical again”. He’s been pretty successful too, with block fees recently exceeding block rewards.

This is a big deal, because as block rewards diminish with each halving, increased fees are needed to incentivise miners to maintain the Bitcoin network. How this was going to happen has been a subject of intense debate for many years, and even academic research. That problem, however, seems to have been solved by Ordinals.

Beyond Udi, Michael Saylor also recently mentioned that Ordinals have "crossed this chasm from what was a bearish scenario to a bullish scenario." He believes that Ordinals and inscriptions are an important conversation and that they can potentially positively impact the Bitcoin mining network.

However, others believe Ordinals go against the original vision of Bitcoin as a peer-to-peer electronic cash system. They argue that Bitcoin should only be used for secure financial transactions, and ordinal inscriptions needlessly fill up Bitcoin’s blockspace, driving up transaction fees.

Bitcoin core developer Luke Dashjr, states that Ordinals and their inscriptions are nothing more than an exploit allowing users to spam the blockchain.

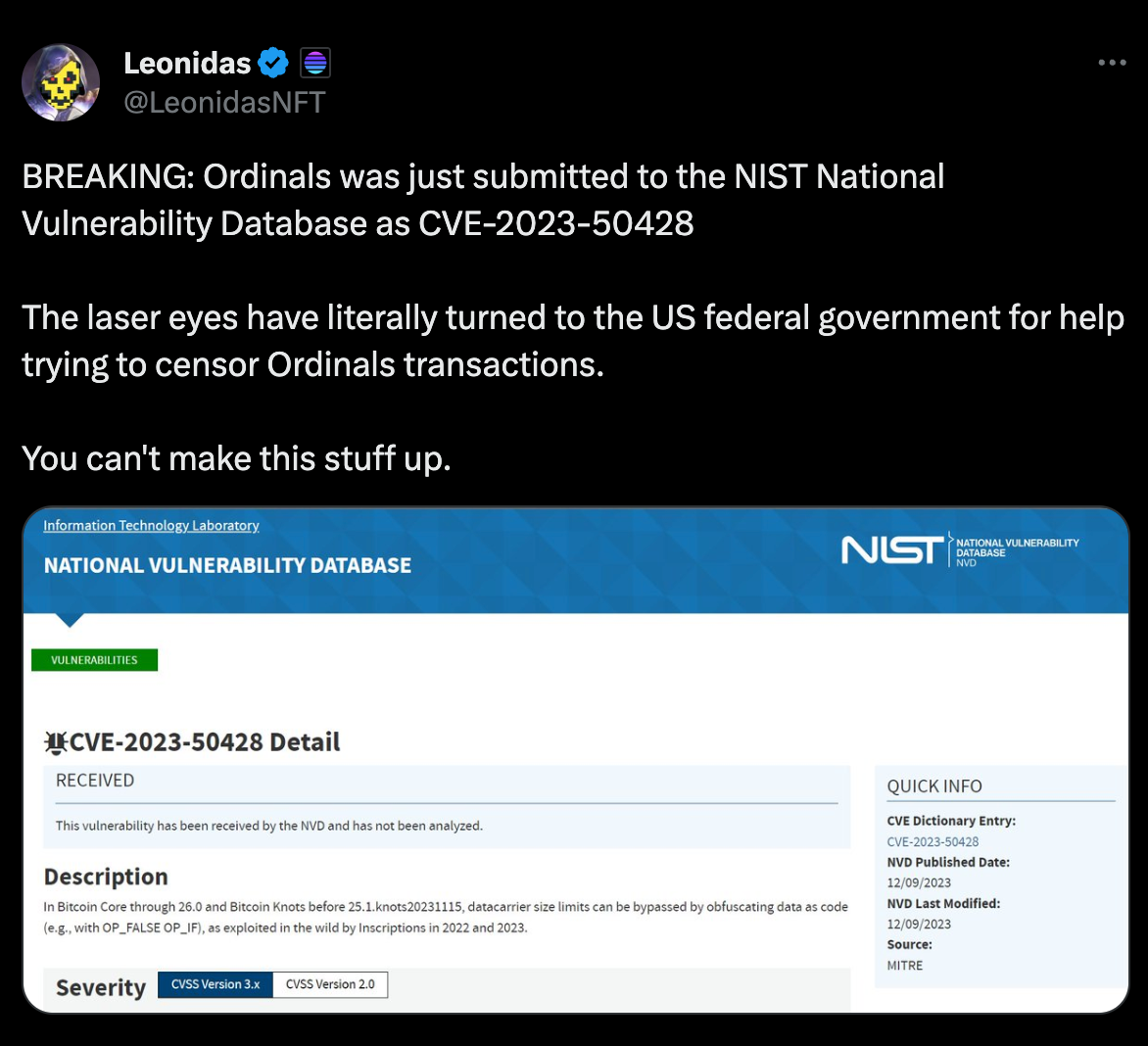

In an interesting and ironic turn of events, Ordinals got submitted to the NIST security vulnerability database. For those of you who don’t know what this means, the below tweet pretty much explains it all.

If we boil these perspectives down to their core, it all seems to come down to censorship and perspectives on freedom.

Which side you buy into ultimately stems from ideological differences. If you’re leaning towards siding with LukeDashJr, we’d ask you to consider the tweet below before making any decisions.

Regardless of the debate's outcome, removing the ability to create ordinal inscriptions would require an update to the Bitcoin protocol.

This means it’s ultimately down to the Bitcoin community to decide whether ordinals are here to stay or just a passing fad.

It seems like the community is closing in on a decision, too, as LukeDashJr’s mining pool has started mining Ordinals. Udi, per the tweet below, seems pretty happy about this.

The future is looking bright for Bitcoin

It’s been a long time since the Bitcoin network has captured this much attention, and with the flurry of new protocols and platforms supporting BRC-20 and the SEC’s spot ETF approval, we might be shaping up for a Bitcoin summer this year.

As we get closer to the halving, we’ll be watching the saga unfold with bated breath.

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes to their investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.