What are Cryptocurrency Dark Pools?

Written By: Neal Wen Translated by: Alex D’Amour

In traditional investing, Dark Pools refer to private exchanges that operate independently of public exchanges like the NYSE and the NASDAQ. In Dark Pools, large organizations or investors can trade large volumes of stock, derivatives, and other financial products anonymously and discretely. An estimated 15% of all trading volume in the American stock market takes place in Dark Pools, with some estimates putting it as high as 40%.

With a market capitalization of 1.32 trillion dollars, the Korea Exchange (KRX) is relatively modest by global standards. However, the KRX is already much larger than the entire cryptocurrency market. The cryptocurrency market has a market cap of about 200 billion dollars in total, but unfortunately, it is sparsely divided among 500 cryptocurrency exchanges. This is why liquidity is a perennial issue in the cryptocurrency space; liquidity is spread too thinly among too many exchanges.

Because liquidity in the cryptocurrency market is not sufficiently scaled or dispersed, large investors are prevented from entering the market. Imagine if the market depth was ten times deeper or even one hundred times deeper. Large investors could join in more easily by buying ten or even one hundred bitcoins at a time while still receiving the best execution.

Who can make this a reality?

WOOTRADE can.

WHO IS WOOTRADE?

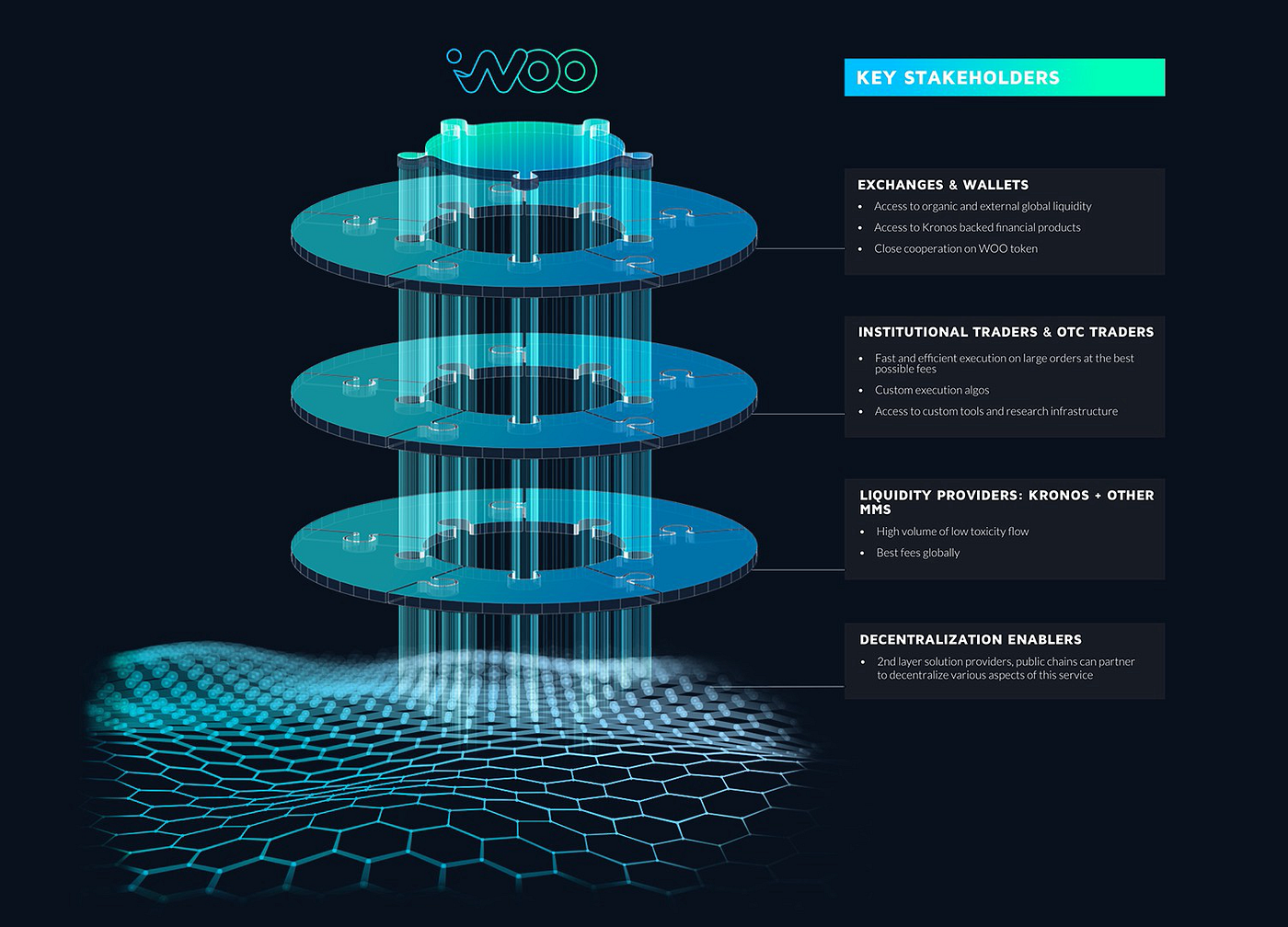

WOOTRADE is a digital asset dark pool incubated by the quantitative trading team Kronos Research. WOOTRADE provides the best execution and deep liquidity for institutional clients by partnering with elite exchanges, OTCs, and quant teams, such as Kronos.

FOUNDERS

Mark Pimentel — Co-Founder

Graduated from Carnegie Mellon University with a Bachelor’s degree in Finance and Computer Engineering and a Master’s degree in Computer Engineering. He joined Citadel Investment Group’s high-frequency trading unit in 2006, which earned $892M in 2007 and $1.15B in 2008. He continued his career at Knight Capital’s electronic market-making group, where his team operated the largest dark pool in the United States and Europe. Following this success, he went on to manage trading groups in global futures and equities in Chicago.

Jack Tan — Co-Founder

Graduated from Carnegie Mellon University with a Bachelor’s degree in Finance. Jack started trading at 14 years old and is an experienced discretionary trader in both traditional and digital assets. He has a comprehensive understanding of the crypto-landscape and is adept at identifying, creating, and capitalizing on market trends. He also has ten years of experience in sales and trading at Deutsche Bank and BNP Paribas.