BTC Spot ETF ‘fake-pump’ - a sign of what’s to come?

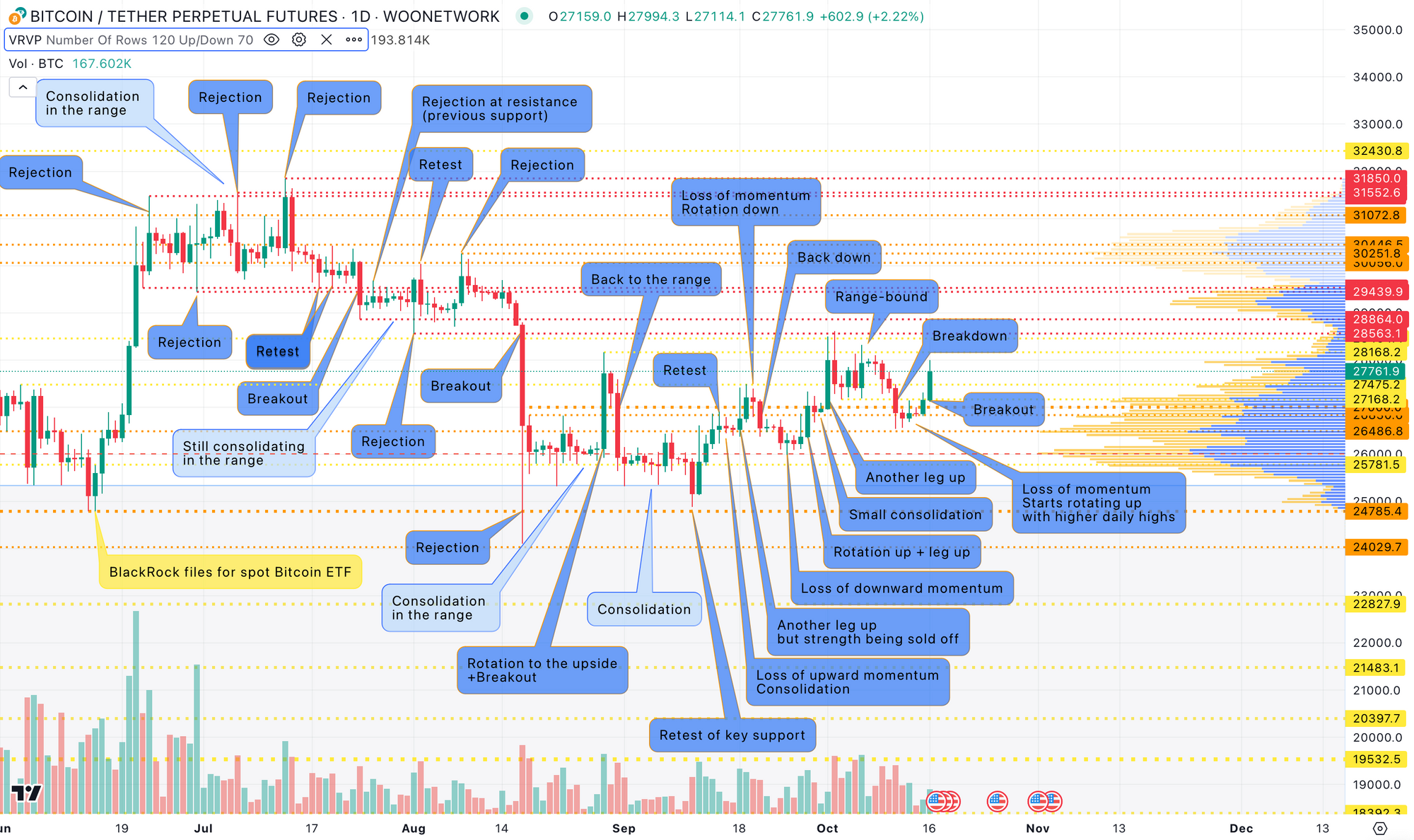

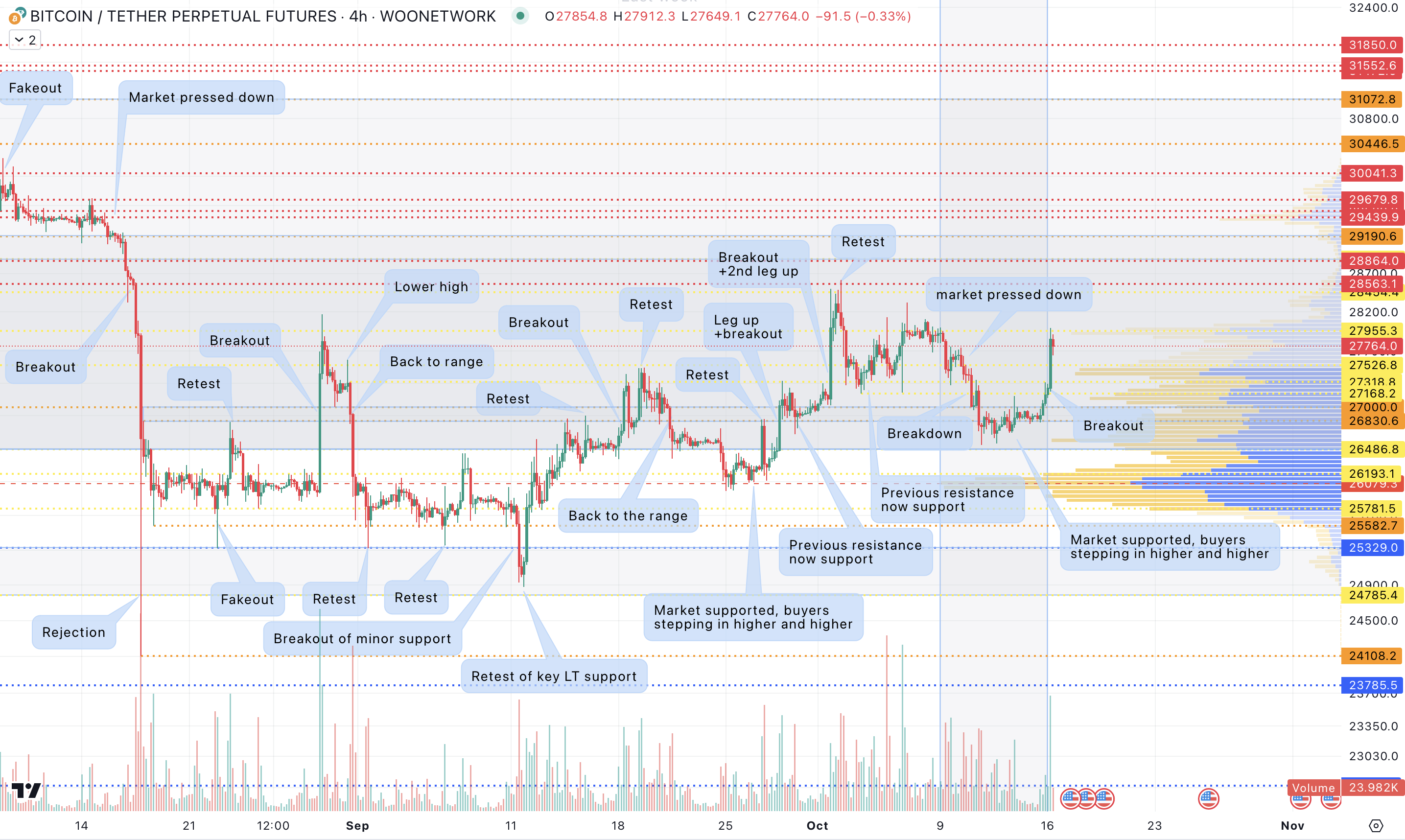

BTC started last week not much changed, trading in the tight range set over the weekend close to $28,000.

US equity index futures opened with a gap down and oil with a gap up on turmoil in the Middle East on Sat, which also started weighing on crypto.

BTC slowly pressed down and that intensified later as we got below the weekend range.

Prior week’s low was initially limiting the downside on Monday and Tuesday.

BTC continued to be weak even though other risk assets like equities recovered their losses and were going up.

Bulls were definitely struggling to push BTC up with lots of absorption from the offers on bounces.

It eventually sold off further on Wednesday to break below prior week low.

Higher PPI only added to the selling pressure and sent BTC down to $26,500, before it started retracing in anticipation of CPI on Thursday.

Core came out as expected and headline stronger, which caused some selling again but this time, there was quite a lot of absorption from the bids and BTC didn’t manage to get below Wednesday’s low.

The focus turned to Friday's deadline for SEC to appeal its court decision on Grayscale spot BTC ETF.

As time was passing, the chances for no appeal were increasing, which supported BTC.

Late on Friday, news hit that SEC wouldn’t appeal, which caused a spike on BTC, but previous week’s low worked as resistance, limiting the upside and the move retraced.

Nonetheless, the market was supported from the downside and that was so till the end of the week, with buyers coming in higher and higher as enthusiasm about spot BTC ETF approval increased.

Eventually, BTC finished last week lower than where it started.

However, its inability to post follow-through on the break of prior week’s low suggested increased chances of the move to be just a deviation before another move to the upside.

It was confirmed by a move to the upside early this week on Monday.

We’re now approaching $28,000 with the key challenge at $28,550, which marks the high of the range we’ve been staying in for almost 2 months now.

As mentioned a few times before, daily close above is crucial from a longer term perspective to be confident about the long side, and think about targeting ‘23 high.

Last week’s retracement and deviation below prior week low, which shaked out some longs in the process and gave us higher swing low in daily timeframe was very healthy for the uptrend that started on Sep 11 from the bottom of the range at $24,800.

That makes the chances of an eventual break out much higher than on previous attempts.

From the downside, the key area to watch is $27,300 - $27,000 and then $26,500 and $26,000 levels which mark swing lows.

Update: A huge spike to $30,700 happened on fake news from Cointelegraph about iShares spot BTC ETF approval, which later fully retraced.

Our game plan remains the same in higher time frames with a focus on daily close.

As the news (even though fake) came as a surprise, caused a violent move and cleared a lot of liquidity, we can expect thinner market conditions with more choppiness in lower time frames.

Trade now on https://x.woo.org/ and follow @KTGglobal for more trading insights.

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes to their investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.