July's stable job data lowers the chance of a big Fed rate cut

by Tiffany Wang, WOO Analyst

The US Consumer Price Index (CPI) rose by 0.2% last month, bringing the 12-month inflation rate down to 2.9%, the lowest level since March 2021. Core CPI, which excludes food and energy, also increased by 0.2% monthly and 3.2% annually, in line with expectations. Notably, a 0.4% rise in shelter costs accounted for 90% of the total inflation increase, once again defying the Fed's hopes for easing in housing-related expenses.

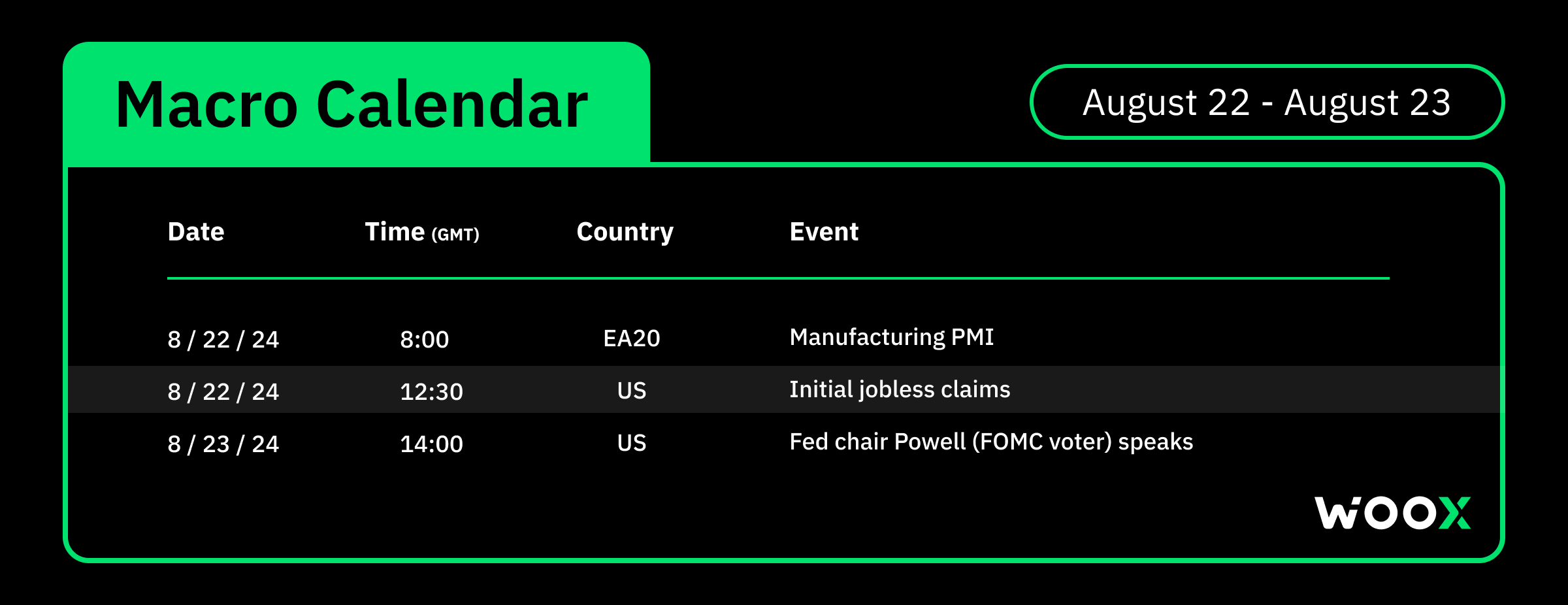

Meanwhile, new unemployment claims fell to a one-month low last week, signaling a steady labor market. This tempered financial market expectations of a 50 basis point rate cut by the Federal Reserve next month. Further bolstering the economic outlook, consumer spending surged in July, with retail sales rising by 1%, far exceeding forecasts and easing recession concerns.

Market Overview from WOO X Research

BTC remains in a consolidation phase, staying above the critical support of $55,000. Short-term resistance is at $61,147, with potential upside targets of $64,141 and $66,000 if a breakout occurs. The uptrend is intact as long as BTC stays above $55,000.

Meanwhile, Solana's profitability has declined, prompting a shift in funds to older tokens on CEXs, although this hasn't yet had a significant market impact.

As volatility decreases, the market is either awaiting a BTC breakout to lead a broader recovery or looking for wealth effects to lift key assets and attract investor interest.

Visit WOO X Research for additional insights

—

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.